February 14th is Valentine’s Day, so let’s show some love to our future selves by building a financially secure future.

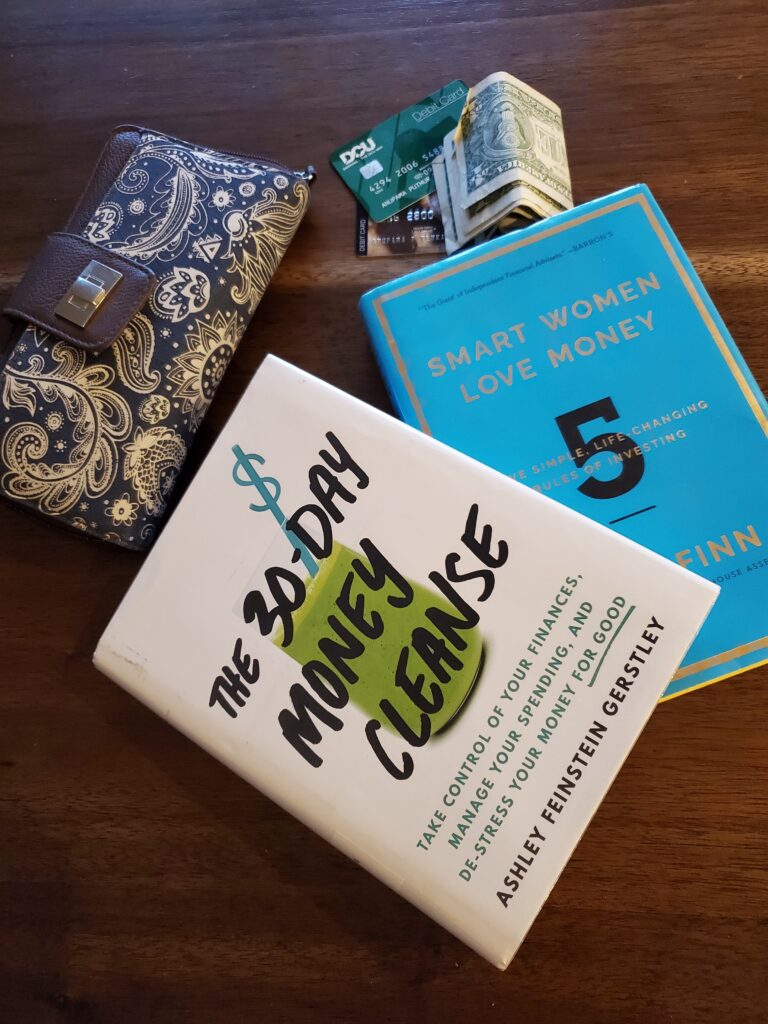

This post is about 2 excellent books on managing your money smartly, whether you are just out of college and tackling a mountain of student debt, or a seasoned professional worried about retirement savings, or a parent wondering how to save for your kids’ college fees, or anywhere in between.

Smart Women Love Money

Title – Smart Women Love Money

Author – Alice Finn

REVIEW SCORE – 4/5 ****

About 90% of people have absolutely no clue about how to save or the basics of investing. Colleges sadly don’t teach this important life skill, and young people are thrown unprepared into the adult world. This is a great starter book for anyone (not just women) who want to create financially security for life!

However, if you already have a 401(k) account with index funds and 6 months of emergency funds, then this book will feel very basic. I felt the whole book could be condensed into a simple blog post “list” type article. That said, appreciate that the author provided lists of index funds for various risk appetites, and some good pointers on saving more on taxes.

30-day Money Cleanse

Title – The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-stress Your Money for Good

Author – Ashley F Gerstley

REVIEW SCORE – 5/5 *****

Love this book because it is practical and actionable! The book has a simple flow and makes it easy to start working on the core principles of saving and investing – understand cash flows, assign budgets to broad segments and automate savings. It doesn’t matter whether you are just out of college or earning a 7-figure income. This book will coax you to get on the right path to a stable financial future, without waiting for retirement to have a fun and enjoyable life!

Unlike many other authors (and financial gurus), this book does not reprimand or guilt you about money mistakes in the past. This book will literally allow you to cleanse away any past money “sins” and get on the right track!

Even if you have good money habits, I suggest the book as an annual exercise, to ensure you are on the right path, and to confirm you don’t have unnecessary subscriptions that are subtly hurting your financial goals. I found myself canceling online magazines that I never read and some unnecessary fees that I had overlooked. These may seem like pennies, but they add up to hundreds over a 3-5-year time frame.

Fantastic book, and I highly recommend.